Board Of Directors

Sydney Yates OBE

- Acting Chairman

Monica Salter DBE

- Non-executive Director

Professor David Kavanamur

- Non-executive Director

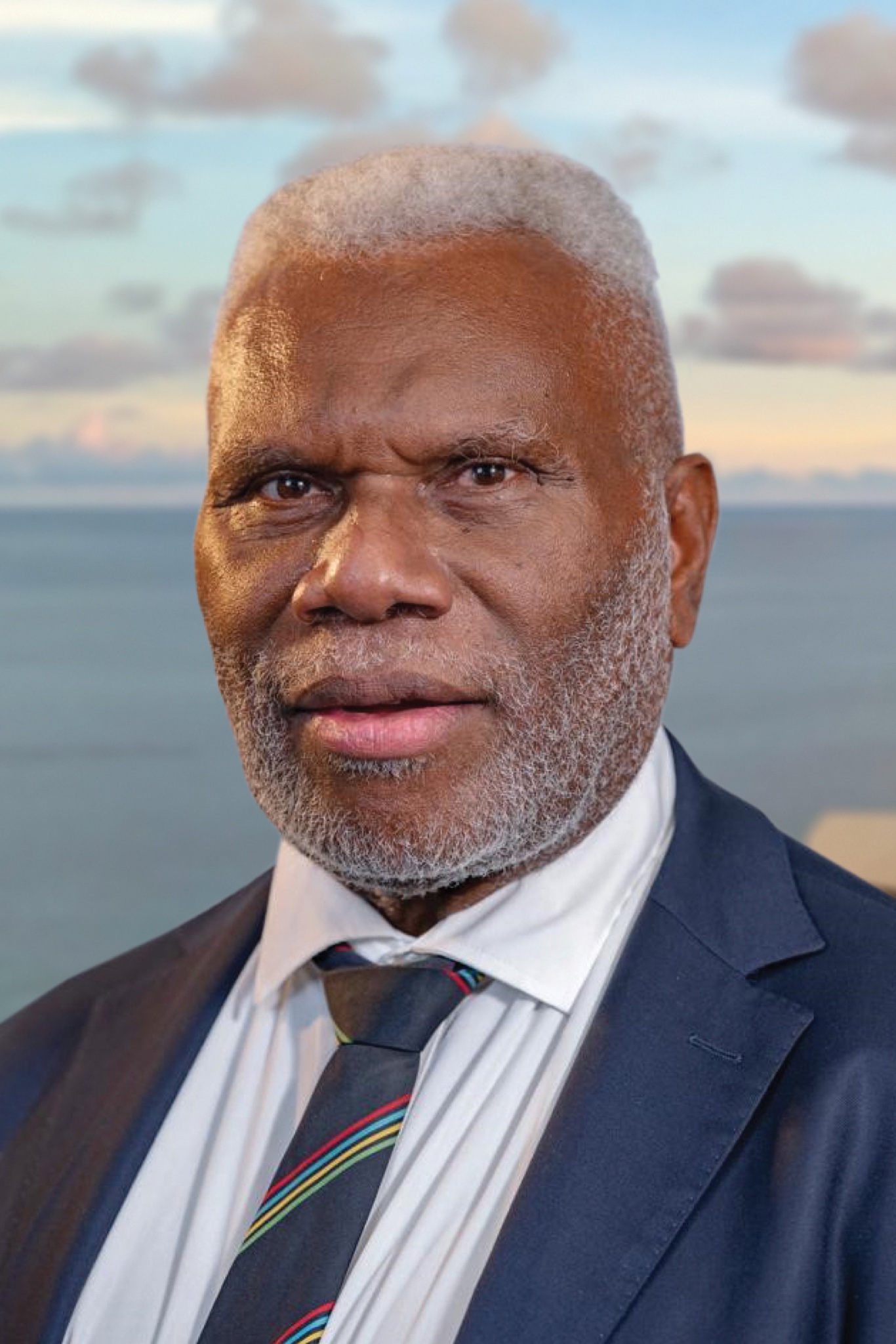

Dr Albert Mellam

- Non-executive Director

The Board of Directors plays a critical role in guiding the overall strategy and maintaining sound governance for the Company. This includes strategic planning, risk management, financial oversight, and compliance. Additionally, the Board ensures transparency and ethical practices while delegating operational responsibilities to management, maintaining a balance of independence, and carefully addressing potential conflicts of interest among members.

Role and Responsibility of the Board

Key functions of the Board include:

- overall strategy of the Company, including operating, financing, dividend, and risk management.

- approving an annual strategic plan and an annual budget for the Company and monitoring results on a regular basis.

- ensuring that appropriate risk management systems are in place, and are operating to protect the Company’s financial position and assets.

- ensuring that the Company complies with the law and relevant regulations, and confirms with the highest standards of financial and ethical behaviour.

- establishing authority levels

- directors’ remuneration

- selecting, with the assistance of the Audit Committee, and recommending to shareholders, the appointment of external auditors.

- approving financial statements.

The Board has delegated to management responsibility for:

- approving financial statements.

- developing the annual operating and capital expenditure budgets for Board approval, and monitoring performance against these budgets.

- developing and implementing strategies within the framework approved by the board, and providing the Board with recommendations on key strategic issues.

- developing and maintaining effective risk management policies and procedures.

- keeping the Board and the market fully informed of material developments.

Membership, expertise, size and composition of the Board

The Corporate Governance Principles determine that the majority of the Board should be independent.

At the date of this Report there are 3 directors, with 2 Non Executives designated as independent, plus the Managing Director. Under the Constitution, at each annual general meeting one-third of the company’s Directors, in addition to any Director appointed during the year, excluding the Managing Director, must offer themselves for re-election by the shareholder. Normally, Non-Executive Directors are expected to serve a maximum of four three-year terms, dating from the AGM at which the newly elected Director is first confirmed by shareholders.

The Board has a broad range of skills, experience and expertise that enables it to meet its objectives. The Board accepts that it has responsibility to shareholders to ensure that it maintains an appropriate mix of skills and experience within its membership.

As is typical of small financial markets generally there are, in Papua New Guinea, very considerable demands on the relatively small numbers of people with the skills and experience to fill the demanding role of Non-Executive Director on the Boards of the nation’s corporate institutions.

In these circumstances it is inevitable that a number of the Non-Executive Directors of KAML will also have roles on the Boards, or in Senior Management, of institutions that may be significant shareholders in, or substantial customers of, the Company.

Directors of KAML are meticulous in handling situations where there could potentially be conflicts of interest, by declaring their interests in advance, and absenting themselves from any consideration of matters where a conflict might arise. The Company’s Corporate Governance Principles require Directors to disclose any new Directorships and equity interests at each Board meeting.

The Board does not accept that any office bearer and/or employee of an institutional shareholder will have an automatic right to be appointed to the Board.